Being in to business of providing skilled manpower and developing skills for the Industries, we know that situational awareness plays a vital role in providing the competitive advantage. We also acknowledge the fact that everyone is busy and might not get the time to keep himself updated with the latest business news. Hence we thought of publishing a news digest kind of blog post for our readers. Hope our efforts help you in being informed about the latest happenings of the Indian Business World.

Government readies to sell NHPC stake to state-run peer NTPC, say sources

The Ministries of Finance and Power are discussing a plan to sell the government’s 73.67 percent stake in NHPC to NTPC, which is owned 62.7 percent by the government.

The government is in talks to sell its stake in hydro power producer NHPC to its state-run peer NTPC, the country’s biggest electricity generator by capacity, say sources.The Ministries of Finance and Power are discussing a plan to sell the government’s 73.67 percent stake in NHPC to NTPC, which is owned 62.7 percent by the government.Through the stake sale, the government is looking to exit from NHPC. The talks are at an initial stage and a deal is unlikely to be concluded this fiscal year, sources told CNBC-TV18.

SEBI moving to simplify de-listing of companies

Nearly 15 years after the reverse book-building method of price discovery was introduced, SEBI is studying if it can do away with it for de-listing companies.A source close to the development told BusinessLine that one of the options suggested by an expert committee was to replace the current de-listing method with the tender offer route, where the company promoters would give shareholders a price range.While there is a consensus within SEBI that the reverse book-building method needs to go, the alternative is yet to be fine-tuned, the source said.SEBI wants to simplify the process of de-listing companies from stock exchanges to plug holes in the rules that could lead to potential misuse.The premise of the reverse book-building method was that investors had to bid in an auction to buy shares in an IPO, so in giving them an exit, a similar procedure should be followed.

Floor price

Under reverse book-building, the average closing price of an equity share in the previous 26 weeks or six months is set as the floor or the minimum price that the shareholders will have to be paid by the promoters who intend to de-list.The floor price is often set assuming that it is higher than the ruling or prevailing price in the stock market. Shareholders then have an option to tender their shares at the floor price or quote the price above it. After the closure of the bid, the company has to consider a cut-off price for buying the shares back at which the maximum number of shares were bid.

The promoters reserve the right to accept or reject the bid. History shows that such a method had its pitfalls.

Pitfalls in earlier system

“Doing away with reverse book-building could be good as the process was often rigged,” said Sandeep Parekh, founder, Finsec Law Advisors.

“The pricing power under reverse book-building was with those few who could corner shares and play the game. But it will not be nice if the new method too is similar to the current one as a tender offer does not sound much different,” he added.

Ahead of a de-listing announcement, promoters would typically corner shares through front entities and tender them at the lowest price. Also, in many cases market operators jacked up the share price once they got a whiff of the imminent de-listing.

“Finding a process for de-listing that is fool-proof and that largely benefits retail shareholders remains a task for the regulator, and it will be interesting to see what course it takes,” said a former SEBI official.

Center must exercise caution

South Korea is aggressively pushing for speeding up negotiations on expanding the existing Comprehensive Economic Partnership Agreement (CEPA) with India. But instead of rushing ahead, New Delhi should pause and take a clear look at where it is heading.

Since the bilateral CEPA was implemented in 2010, South Korea’s exports to India jumped from $10.47 billion in 2010-11 to $16.36 billion in 2017-18. India’s exports to South Korea, however, remained sluggish and increased insignificantly from $3.72 billion in 2010-11 to $4.46 billion in 2017-18. As a result, the trade deficit between South Korea and India increased to a staggering $12 billion in 2017-18.

These are numbers that should not be taken lightly. They show that while Indian businesses have not been able to take advantage of the provisions of the CEPA. But Korean companies have increased their exports taking advantage of the lower duties.

Moreover, much of the Indian exports to South Korea are still taking place outside the CEPA at higher duties. According to various studies, including one by the ADB, the average utilisation of free trade pacts ranges between just 5 per cent and 25 per cent in India. That is mostly because Indian exporters find it too onerous to meet obligations such as rules of origin. Low awareness is another reason for low utilisation.

With lack-lustre growth in India’s exports to South Korea, and much of it happening outside the ambit of the CEPA, there is clearly no point in expanding the pact, until and unless it provides more market access to Indian goods. But that is certainly not going to happen as South Korea has made it clear that it wants increased market access in a number of items including sensitive ones like automobiles and textile that got excluded in the original CEPA.

Agreeing to an Early Harvest Programme for the CEPA, under which India would speedily cut down duties on 11 items and South Korea on 17 items, might have been a diplomatic necessity to mark South Korean President Moon Jae-in’s visit last week. Going beyond it would be foolish.

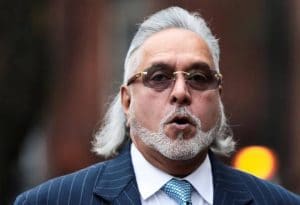

Vijay Mallya willing to come back home?

Embattled liquor baron Vijay Mallya, the main accused in a Rs 9,000 crore alleged bank fraud case, is understood to have sounded out to Indian authorities that he was willing to come back home to face the law, official sources said. Mallya, who is contesting in a London court the Indian government’s action for extradition, is said to have sent feelers to authorities that he would like to join the legal process in India and contest the recent action against him under the Fugitive Economic Offender Ordinance.Under this recently promulgated ordinance, the government can immediately confiscate all linked properties of Mallya in the country and abroad.However, top sources in investigative agencies said the final contours of the move are still not clear as they refused to divulge more details.A special Prevention of Money Laundering Act court in Mumbai had last month issued summons to the beleaguered businessman to appear before it on August 27 on the Enforcement Directorate’s plea seeking action against him under the Fugitive Economic Offenders Ordinance in the over Rs 9,000 crore bank fraud case.

The central probe agency, as part of this action, has also sought immediate confiscation of assets worth around Rs 12,500 crore of Mallya. If he does not appear before the court or respond to its summons on the designated date, Mallya risks being declared a fugitive economic offender, besides properties linked to him being confiscated.

Mallya, his now defunct venture Kingfisher Airlines Limited and others availed loans from various banks during the tenure of the UPA-I government and the outstanding amount, including interest, against him is Rs 9,990.07 crore at present, officials had said. He had recently said he has become the “poster boy” of bank default and a lightning rod for public anger.The liquor baron had said that he had written letters to both the prime minister and the finance minister on April 15, 2016, to explain his side of the story.Both the Enforcement Directorate (ED) and the Central Bureau of Investigation (CBI) have filed separate criminal cases of alleged loan default against him.A hearing in the extradition case is expected to be heard in London this month end where a team of Indian investigators will remain present.

News Source ; Business Line & Money Control.